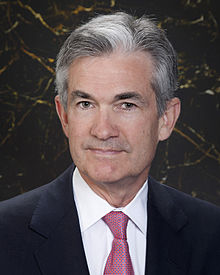

Jerome Powell

Wednesday's news from the Federal Reserve’s two day meeting gave a surprise to many observers and government officials when they announced a “sooner rather than later” rate increase at the end of 2023, to be exact, by 0.6 % from the long held zero percent.

Statements at the press conference from Fed Chair Jerome Powell caused 10 year Treasuries to hit 1.569 percent from the previous 1.498, and caused the Dow Jones to drop to 0.8 percent lower according to the Wall Street Journal.

While the news was a surprise, it was tied to a strong recovery for the US economy and fears of higher inflation that has crept, some say alarmingly fast, with increased consumer spending.

People have been sitting on a pile of accumulated cash, from the pandemic lockdowns, stimulus checks, and their actions have been supported by increased vaccinations; a marked departure from a few months ago, and the Fed noted in a later statement that, “Progress on vaccinations has reduced the spread of Covid19 in the United States.”

It seems that the Fed is taking both caution, as well as recognition of these economic realities which have others concerned about inflation seeing price increase on services, rather than goods, as consumers are now ready to travel, with restrictions lifted by state and local governments, coupled with the increased vaccinations.

“We wouldn’t hesitate to use our tools to address that,” added Powell about fears of inflation.

The current thinking, from she and Powell, is that inflation will be allowed to increase, with an expected decrease; but, the Labor Department has noted from their own consumer price index, that in May, there was a 5% increase from a year earlier, with current averages at 3.4%.

While employment is one of the two mandates for the Reserve, (along with keeping inflation at 2%) there have been mixed numbers; and with April and May, adding a total of 837,000 jobs, many are unsure of the future.

The response from the general public has been muted; but, there are still 7.6 million jobs less than February of 2020, the baseline measure, causing even more concern in the Biden administration.

As we previously have noted, some of those jobs may never come back and the increase of retirement is pulling down labor force participation, said Powell, and the Journal noted, “Some 2.6 million people retired between February 2020 and April of this year, according to estimates from the Dallas Fed.”

Powell noted that the unreliability means that predicting will be difficult, and said, “So we don’t know exactly what labor force participation will be as we go forward.”

There are still those who are reluctant to enter the job market for fears of crowded office spaces, equally crowded forms of public transportation, lack of child care (which might improve in the Fall) and a desire to change jobs for higher wages and better working conditions; all of which, for some have been eased by the $300 in extended unemployment benefits, but which some lose as early as the weekend as 25 states are ending them, as they feel it is an impediment to seeking employment.

Thursday did see an increase in weekly jobless claims by 37,000 to 412,000, from the past week, but the four week average has set a new normal level of 395,000, the lowest since March 2020, when the virus first surged in the US.

It’s obvious that the US economy is on an uneven road to recovery post pandemic, but it’s also true that the changed landscape has upended previous thoughts and assumptions about what can be believed and changed, or in the words from a previous editorial meeting, “This isn’t your grandpa’s recovery.”